An Overview of In-Store Tracking Technology – 2022 UPDATE

An Overview of In-Store Tracking Technology – 2022 UPDATE

By Gary Angel

|January 4, 2022

The most popular blog post on Digital Mortar is An Overview of In-Store Tracking Technology. It still gets plenty of traffic (thanks Google) but since it was written in 2017 it desperately needs a refresher. Since we wrote it Digital Mortar has had an opportunity to field test plenty of other hardware options AND the technology itself has made strides. So here is a 2022 update to that post and if you’re looking for a better understanding of this technology can do check out this video or digitalmortar.com/shopper-journey.

People tracking technologies covered in this post –

-

-

- Stereoscopic/3D Optical/Matrix Cameras

- LiDAR

- Bluetooth

- WiFi

- Smartphone App

- Loss Prevention Cameras

- Other Electronic (Smartphones)

-

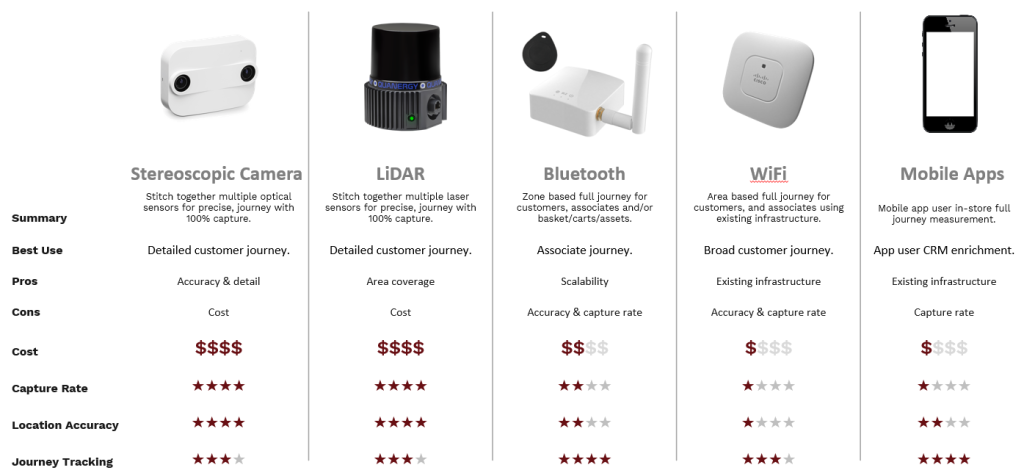

In terms of grading/considering hardware options we typically look at the following criteria –

-

-

- Capture Rate – What percentage of total people who enter the tracked space are tracked.

- Journey Tracking – How capable is the hardware of tracking end to end journeys within the tracked space.

- Location Accuracy – How precisely the technology tracks the location of a person within the tracked space at any given moment in time.

- Cost – The total cost of ownership, inclusive of hardware, installation, and maintenance, of the hardware in relation to other people journey tracking options.

-

Based on those criteria, here’s how we stack up the various people tracking technologies most deployed. One star is worst and four is best.

*Loss Prevention Cameras and Other Electronic are intentionally unrated in the table, see detail below

3D Optical Sensors/Stereoscopic/Matrix Cameras

Summary: Stitch together multiple optical sensors for precise, journey with 100% capture.

Example Manufacturers: Xovis, Hella

Best Use: Detailed customer journey.

Pros: Accuracy & detail

Cons: Cost

Cost: About $900 per sensor and, variable based on environmental details, $300 to $1,000 per sensor for installation.

How they work:

Optical sensors containing two camera lenses and are ceiling mounted giving them a 3D birds eye view of the environment. Each sensor can see up to about 1,000 square feet but can be ‘stitched’ with neighboring sensors to create a larger continuous field of view. The sensors use ‘edge’ based processing so, although they use cameras to initially capture data, that is translated into raw data on the sensor itself so that no video is ever transmitted. They are PoE powered and require a direct ethernet ‘homerun’ back to a switch.

Digital Mortar’s Take:

One of the current leading technologies in the people tracking space. The sensors passively, anonymously, securely, and accurately track the journeys of 100% of people within a measured space — and get our highest grades possible on Capture Rate and Location Accuracy. Person tracks do sometimes break momentarily due to environmental obstructions, people bending down, etc. so it is not possible to take a native feed from the hardware and expect it to contain perfect entry to exit records. Smart stitching logic, like we have developed at Digtial Mortar, can be employed to rejoin person records and allows us to still give the hardware an excellent 3 out of 4 stars for its Journey Tracking capabilities.

Installation is involved and the hardware isn’t cheap so broad scale rollouts to hundreds of locations is likely not an initial consideration, but anyone serious about understanding their environment should be considering optical sensors.

LiDAR

Summary: Stitch together multiple optical sensors for precise, journey with 100% capture.

Example Manufacturers: Quanergy, Blickfeld

Best Use: Detailed customer journey.

Pros: Area coverage

Cons: Cost

About $4,000 per sensor and, variable based on environmental details, $300 to $1,000 per sensor for installation.

How they work:

A light-based radar system that maps the environment and tracks people by identifying movement. Sensors can be ceiling or wall mounted and ‘see’ horizontally (as opposed to 3D optical sensors that use a birds eye view). They are PoE powered and require a direct ethernet ‘homerun’ back to a switch. Coverage provided by most makes/models capable of people tracking is typically dictated by environmental obstructions but under ideal conditions sensors can cover upwards of 10,000sq ft each. Multiple sensors can be stitched together to create continuous, obstruction free tracking areas of any size in indoor/outdoor/blended environments. An on-prem processor is used to handle all data processing prior to sending raw data to the cloud.

Digital Mortar’s Take:

LiDAR, despite being a fundamentally different technology, produces a near identical raw data stream to 3D optical sensors so much of our thinking (intentionally) sounds repetitive to our taken on 3D optical sensors.

One of the current leading technologies in the people tracking space. The sensors passively, anonymously, securely, and accurately track the journeys of 100% of people within a measured space — and get our highest grades possible on Capture Rate and Location Accuracy. Person tracks do sometimes break momentarily due to environmental obstructions, people bending down, etc. so it is not possible to take a native feed from the hardware and expect it to contain perfect entry to exit records. Smart stitching logic, like we have developed at Digital Mortar, can be employed to rejoin person records and allows us to still give the hardware an excellent 3 out of 4 stars for its Journey Tracking capabilities.

Despite LiDAR’s much higher price tag per sensor, whether a LiDAR or 3D optical sensor based full journey deployment will be more cost effective is largely environmentally specific. Digital Mortar commonly uses the technologies nearly interchangeably and will pick whichever comes in at the lowest cost of ownership for our clients.

In general, LiDAR is a much newer technology to the people measurement space than 3D optical sensors. The LiDAR ecosystem is still evolving but, in its current state, the technology is excellent and longer term the people tracking upside is near limitless.

Bluetooth

Summary: Zone based full journey for associates and/or basket/carts/assets.

Example Manufacturer: SATECH, MINEW

Best Use: Associate journey.

Pros: Scalability

Cons: Location accuracy

Cost: $150 for Bluetooth signal receiver sensor and $8 to $15 per Bluetooth tracking beacon.

How they work:

Beacons, ranging in size from a silver dollar to a thick nametag, can be worn or permanently affixed to carts, baskets, or physical assets. The devices will transmit probes at a frequency and strength predetermined by their customizable settings and Bluetooth signal receivers positioned throughout the tracking environment collect the probes. Signal receivers require some form of power, PoE or wall plug, while beacons are battery powered with battery life ranging from 6 months to 5 years depending on make/model.

The geolocational position of the beacon is determined by using the relative signal strength (RSSI) collected by the surrounding signal receiver sensors. Common positioning techniques include positioning the beacon using the single strongest RSSI and trilateration, but Digital Mortar prefers our proprietary machine learning based approach which matches signal profiles to environmental fingerprints collected during a calibration. The machine learning based approach yields positional accuracy around 3 to 5 meters, while other techniques are typically closer to 8 to 10 meters. The use of angle of arrival (AoA) in BLE 5.0 may improve upon positional accuracy but field deployments of BLE 5.0 are rare at the time of this writing.

Digital Mortar’s Take:

Bluetooth can deliver excellent, continuous journey data. One if it’s strengths is that, unlike LiDAR or 3D optical sensors where person objects can be broken by obstructions, it is unfazed by obstructions.

The positional accuracy limitations make them inappropriate for use cases where submeter accuracy is required, but it will competently deliver ‘zone’ level insights. In customer tracking applications, where it is used on carts and baskets, Bluetooth will never collect 100% of the shopper population but in retail environments like grocery that might not be a significant limitation.

Digital Mortar most commonly deploys Bluetooth as an associate measurement technology alongside 3D optical sensors or LiDAR. This configuration provides comprehensive, unbroken associate tracking as they move from stockrooms to customer facing areas. 3D optical sensors are available with bult in Bluetooth signal receivers so adding this associate tracking capability may not require any additional hardware/installation.

Smartphone App

Summary: Mobile app user in-store full journey measurement.

Example Manufacturer: Indoor Atlas

Best Use: App user CRM enrichment.

Pros: Existing infrastructure.

Cons: Capture rate.

Cost: Software cost varies by location size and quantity

Example Manufacturer: Indoor Atlas

How it works:

Code is embedded in a client’s existing iOS or Android smartphone application. When the app is enabled and the smartphone enters a geofenced area representative of the client’s leased/owned location then the movement of the smartphone is tracked. The geolocation of the smartphone is determined based on a calibrated fingerprint of the environment that uses a variety of available information including GPS, surrounding WiFi access points and nearby Bluetooth beacons. The system technically can be used without any hardware installation and provide satisfactory results but the addition of low cost Bluetooth beacons into the tracked environment will improve positional accuracy to be 1 to 3 meters.

Digital Mortar’s Take:

Embedding tracking in to existing smartphone apps delivers an incredibly rich data set – accurate, continuous, in-store behavioral data. The significant drawback is that it is typically for a tiny fraction of the shopping population. In instances where app users are high value customers where enriching their CRM profiles could pay significant personalization/cross sell/upsell dividends or the apps in-store user base is a meaningful shopper percentage the technology may be a consideration. In most cases app tracking is not a technology that our clients seriously consider.

WiFi

Summary: Area based full journey for customers, and associates using existing infrastructure.

Example Manufacturer: Meraki, Aruba

Best Use: Broad customer journey.

Pros: Existing infrastructure.

Cons: Accuracy & capture rate.

Cost: Zero or some WiFi access point manufacturers charge annual subscription fee to enable required analytics feature

How it Works:

Smartphones with WiFi enabled are constantly pinging out looking for available WiFi access points that they can connect. Access points collect those probes and, using the relative signal strength (RSSI) it is possible to position the smartphone by use of the nearest access point, trilateration or machine learning fingerprinting. A smartphone’s MAC address can be used as a unique identifier that creates a point-to-point journey data stream. Most modern smartphones, however, randomize the MAC address and smartphones with WiFi disabled cannot be tracked in this manner so only a small percent of total traffic can be tracked using this technology. The positional accuracy of this technology is largely dependent on the density of access points within the environment but is typically 8 to 15 meters.

Analytics focused WiFi tracking sensors are available that exclusively listen and collect WiFi probes. These have the advantage of collecting a much higher percent of total WiFi probes (95% vs 50%) and can be deployed in denser configurations that improves positional accuracy to 4 to 6 meters. These devices, however, have the downside that they are not existing infrastructure and carry hardware and installation costs.

Digital Mortar’s Take:

A technology that is appropriate in large environments, like arenas and airports, where positional accuracy is not required for journey measurement, it is acceptable to track a population sample and use of existing infrastructure has significant benefits. WiFi tracking also benefits from environments with high WiFi connection rates since that action stabilizes a devices MAC address and makes it trackable.

In most other environments, WiFi use for journey analytics is not recommended as a primary source. It has some merits/advantages that might make it beneficial as a secondary source to a deployment that also has stereoscopic camera or LiDAR.

Smartphone manufacturer will continue to work on MAC randomization. That makes it almost certain that the share of the population that can be tracked with WiFi will continue to dwindle with time and that significant present day investments in the technology may be unwise.

Loss Prevention Cameras

Loss prevention or LP cameras are an alluring technology in the people tracking space. They provide the benefits of being optical and existing infrastructure. Digital Mortar acknowledges their viability in select people counting and single camera heatmapping scenarios, but we do not consider them an option for full journey measurement. In most cases, LP cameras lack the sufficient overlap to connect people from one camera to the next. When overlap exists, single lens LP cameras are not reliable connecting people from one camera to another. LP camera analytics also has the drawback that it carries the security risk of piping out video for analytics, as opposed to edge based stereoscopic cameras that never transmit video off the device.

If existing LP cameras cover the area (door, queue, display, etc.) you wish to measure then it’s feed may be used for that discreet purpose but the technology should be considered currently non-viable for full journey analytics.

Other Electronic (Smartphones)

Some companies tout the ability to passively track 100% of smartphones with excellent positional accuracy without use of WiFi or Bluetooth. This isn’t a technology used by Digital Mortar but our extensive experience with smartphone electronic based tracking technology makes us skeptical. Typically, anything regarding passive electronic tracking will track only a fraction of the total traffic and it will be positionally inaccurate. It is possible to ‘true up’ electronic based tracking numbers with actual or estimated door counts and we suspect this strategy is used. We do not recommend electronic based technologies where the hardware manufacturers will not disclose how their technology works.