Designing a Behavioral Segmentation for DM1

Designing a Behavioral Segmentation for DM1

By Gary Angel

|January 16, 2024

My last post described the concept of a Segment Set – a group of segments that classify all of the visits to a location. These segmentation sets are perfect for broad usage in enterprise reporting. They describe the core types of visits coming to a location, make it easy to see how successful each visit type is, how important that visit type is to the overall business, and how the distribution of visit types and their success rates are changing over time. Put all that together and you have a powerful window on true performance.

In this post, I’m going to walk through building a typical retail segmentation set. I’m going to keep it fairly generic to maximize its applicability, but keep in mind that the power of a segmentation is often highest when it captures the unique and unusual aspects of a business. And believe me, every business is surprisingly unique!

I’m going to work with a traditional mall apparel store (with data and layout suitably munged for demo). Here’s a look at foot-traffic in the store using our Layout view at the square foot (grid point) and department levels:

For this segmentation, I’m going to use Department for the segment definitions. Department isn’t the most detailed view available (levels are configurable but in this case there’s a Section view in-between Grid and Department), but for a general purpose segmentation, going more fine-grained than this will probably be too complex.

Here’s the same view for department but using average shopper time as the metric:

You can see that the Men’s sections (bottom-half of the location) are a little less trafficked overall and have lower average times.

Here’s a more detailed look at the numbers from this location:

Although Women’s Clearance has the highest dwell to conversion rate (26%) it also has one of the lowest average transaction amounts (under $10). Men’s Clearance, has the lowest average transaction amount of any of the Men’s departments but is pretty average in conversion rate. We can also see that Men’s and Women’s Sports get the most engagement and have some of the highest visit to buy rates. It’s also worth noting the very high Draw Rate for Men’s Active. This looks very much like a strong indication of purpose. A draw is the first place a shopper dwells.

So where to start with a segmentation?

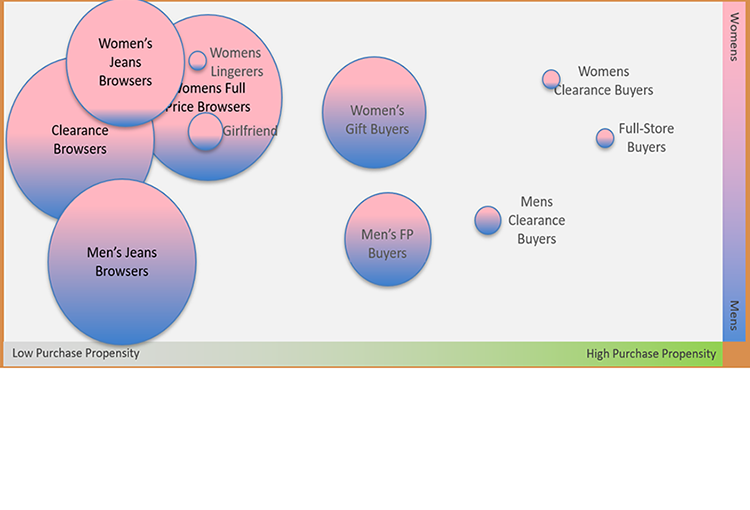

From a broad perspective, it’s obvious that men’s vs. women’s and shoppers who look at both are going to be important. For apparel, gender is a fundamental divide with performance often looking quite different on a gender-basis. And, of course, the whole store is organized on those lines. That means we’ll want to understand the distribution between those two groups, how it’s shifting over time, and how much overlap there is. For those shoppers that did shop both men’s and women’s areas (and they tend to be women, by the way), it might also be useful to understand where they started and how their time skewed.

We’ll also want to separate out product-returners. We may want to distinguish Fitting Room users, but that might be reserved as a success criteria. We’ll also want to distinguish between clearance shoppers and general shoppers and probably, as with men’s/women’s, shoppers who shop both and the balance between them. Clearance shoppers tend to be a very distinct segment, particularly for shoppers who go directly to clearance. Those shoppers may have great metrics in terms of time/conversion, but they aren’t very profitable.

Finally, we may want to distinguish between purpose driven shoppers (those who seem to be looking for something specific) and general store browsers. Success rates for each are usually quite different and particularly for a mall store very different factors may drive the proportion of each in your shopping population.

Usually, we’d consider deeper product affinities and predilections as well. A segmentation might drive down to individual product categories (e.g., like Sports focused since that category is so important in this store). I’m not going to do that here just to keep the segmentation very general.

Here’s my first cut distilling that list down into specific potential segments:

- Product Returners

- Women’s Clearance Focused

- Men’s Clearance Focused

- Clearance Focused (All Genders)

- Women’s General Shoppers

- Men’s General Shoppers

- General Shoppers (All Genders)

- Women’s Purpose-Driven Shoppers

- Men’s Purpose Driven Shoppers

That gives me nine segments – and I’ll probably add a catch-all segment that is all others.

There is no right answer to how many segments are best. It’s rather like the scene in Amadeus when the Emperor complains that his piece has “too many notes”. Mozart, clearly annoyed, responds that there are “just as many as necessary.”

And yet,…you can have too many segments. Because the main purpose of an enterprise segmentation is to drive your core reporting, the number of segments needs to be manageable and understandable. People can’t hold 25 different segments in mind. So, while 20 or 200 or 2000 segments might be appropriate for a segmentation scheme designed to drive personalization, all of those numbers are too large for a segmentation scheme designed for enterprise reporting.

Ten to twelve is a reasonable upper boundary on the number of segments and I would consider collapsing the gender distinction for general shoppers or the distinction between general and purpose driven shoppers so that the total number of segments was in the 5-7 range. Another thing to explore is whether we need the combined Men’s/Women’s segments. I’m guessing we do, but if the percentage of shoppers who shop both is small, it might not be worth including. Note that until we build and apply segments, we won’t know how common the behavior is – the base metrics don’t tell us.

In building segments, you may find that you can take advantage of the priority ordering of a Set to ensure mutual exclusivity without doing too much within each segment’s criteria. That’s not always the case, though.

Because of that, I prefer to start the process with the segments already arranged in the order of priority I mean them to have. Then when I build them, I can quickly determine if I need to add criteria or I can rely on previous assignments to get the exclusivity I want.

Here’s my initial thought about priority ordering:

- Product Returners

- Clearance Focused (All Genders)

- Women’s Clearance Focused

- Men’s Clearance Focused

- Women’s Purpose-Driven Shoppers

- Men’s Purpose Driven Shoppers

- General Shoppers (All Genders)

- Women’s General Shoppers

- Men’s General Shoppers

There’s a lot going on here and I’ll try to explain what’s behind the curtain. In general, you want to organize the segments in terms of the customer’s primary intention or description. A product returner may shop, but the best measure of their performance and intention is to classify them as returning a product. Similarly, if someone goes directly to clearance or spends an overwhelming percentage of their time in clearance then that behavior dominates their other shopping. I’ve put Women’s in front of Men’s only because this location tends to get more traffic in the women’s areas, but the ordering doesn’t really matter. If they shopped extensively in both, they are classified as All Gender. If not, then by definition they only shopped extensively in either Men’s or Women’s and the order doesn’t matter – a shopper can’t be both Men’s Clearance and Women’s Clearance and not already be assigned to Clearance Focused All Genders.

After the clearance segments I put shoppers that exhibited what we would call purpose-driven behaviors – a focus on one particular shopping area. As with the previous discussion, you can’t be both focused and general and you probably can’t be focused on both Men’s and Women’s since that implies shopping more than one area deeply.

Which leaves the general shoppers as the least prioritized in the list. Keep in mind, this is NOT about shopper value, it’s about shopper description and intentionality.

At this point, you may be wondering why I haven’t created something like a “buyers” segment. “Clearance Buyers” vs. “Clearance Shopped” for example. The problem with creating segments based on purchase behavior is that it builds the success metric into the definition. What’s the success of the “buyers” segment that, by definition, has 100% conversion? And what’s the success for the “Shopped” segment when, by definition, their conversion is 0?

At that point, the only success metric becomes the distribution of visits across the segments. That’s harder to grasp and much noisier. If we take the segment definition as “intentional” it must leave room for the store experience to either improve or reduce success rates.

With the segments and ordering in mind, it’s time to create the segments. But since this has turned into a fairly length explanation, I’m going to stop here and tackle the actual segment building in my next post!