Sports Analytics, Stadium Analytics and Sports CRM

Sports Analytics, Stadium Analytics and Sports CRM

By Gary Angel

|March 9, 2017

Optimizing stores is the obvious and primary use-case for the new set of technologies that provide measurement around customer movement through physical spaces. But any reasonably complicated space used by people can benefit from this type of measurement. In my last post, I laid out some general considerations around the space size, the propensity to opt-in, and the nature of the measurement sample that might help ANY business figure out whether and which type of measurement system is appropriate. Those broad considerations are useful for deciding on the measurement collection technology, but the really important consideration is what to do with the data you collect! The simple fact is that the software systems built for retail applications are pretty much useless when it comes to analyzing stadiums or airports. They answer the wrong questions with the wrong techniques. I’m going to take a look at several different non-retail applications of customer-tracking analytics and delve into what makes them different and interesting. And I’m going to start with sports arenas and stadium analytics; partly because I love sports and partly because it’s an absolutely fascinating application area for this new technology!

Stadiums and Arenas: Why CRM has the best seats in the house

Sports team are the most fascinating use-case for customer journey tracking outside of retail. A stadium is like a compact city whose entire population ingresses and egresses over a four-to-five hour period. There are queues everywhere, complex customer experience challenges, and numerous opportunities for journey optimization and revenue enhancement. But as interesting as the opportunities around the physical layout are, the real opportunity for sporting teams is on the CRM side of the house. Most professional sports teams target around 75% of their seating inventory to season ticket holders. My beloved Giants (with their odd string of world series titles) have a considerable waitlist of people who’d love to become “Members”. That population of regulars is enormously important to any franchise. Not only are they heavy consumers and key influencers, they effectively control access to one of the most loyalty enhancing experiences there is – going to a game. When I was about five years old, my Dad took us to see the Cardinals play and I saw Bob Gibson pitch. I was a fan for the next forty years or so until the Giants finally won me over.

As important as TV is from a revenue perspective, it simply doesn’t build a fan the way live attendance does. So it’s no surprise that teams take attendance very seriously indeed – even when TV revenues dominate their short term accounting. As a result, almost every league and every team has spent a good chunk of time in the past decade learning how to do effective CRM. And the core of that CRM program are the fans who attend games. Naturally, teams have been able to do quite a bit of data supplementation around that core fanbase. But there’s a surprising and important gap. Usually, teams have little or no idea how ticket-holders actually use their tickets! Do they attend every game? Most games? Do they bring the same people or different folks every-time? Do they bring family or friends or business associates? Do they like to leave early if the game isn’t close? Do they like to arrive just before the game starts? Are they heavy spenders in stadium (okay – sometimes you do know this)? Are there particular teams they like to see? Customer-tracking with stadium analytics can answer every one of these questions – sourcing absolutely invaluable data to your CRM systems.

I’ve always believed that behavioral data trumps demographics when it comes to targeting. Nowhere is there a more profound, more important, and more immediately applicable set of unused customer behaviors than in sports. This is potentially tracked customer behavior that cuts to the very heart of the fan’s experience, interests and concerns.

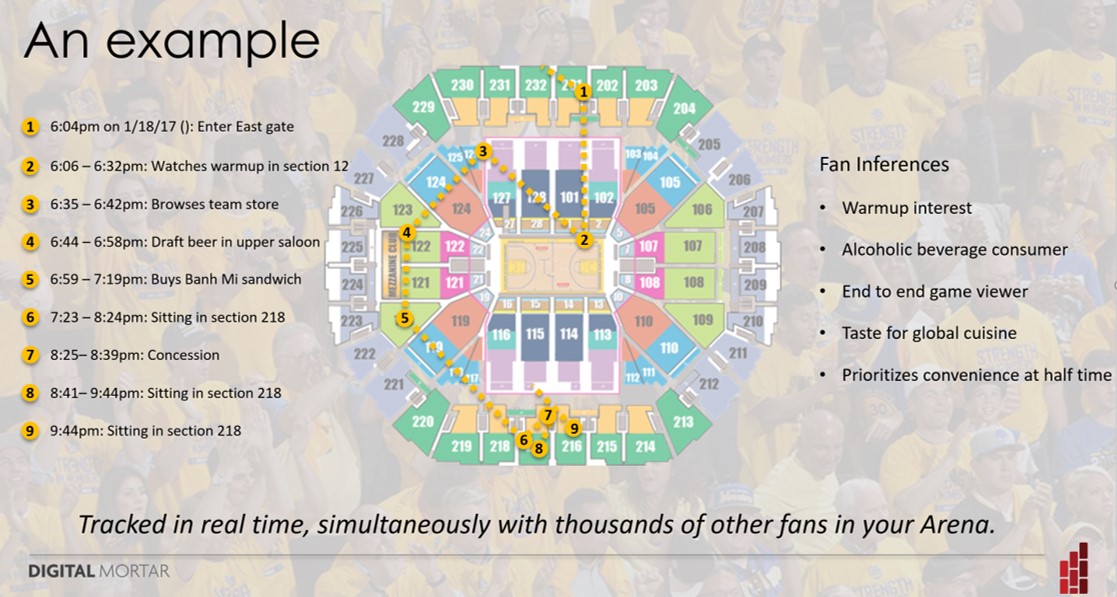

If you want to message and market to your core audience, every one of the question above seems darn interesting. And unlike the situation in retail, with sports teams, the data to tie users to behavior exists and is of relatively high quality. Nearly every sporting venue these days is heavily wired for internet access. At the 49’ers new Santa Clara stadium, a fan is never more than 10 feet way from an access point. 10 feet! A very significant percentage of folks will login to the wifi at a sporting event – providing a unique opt-in opportunity. Taking that data and appending it to CRM data, teams can finally extend their view of their most important customers to their most important set of experiences.

That’s huge.

And the ability to track and optimize the stadium experience? That’s just gravy.

Key Business Questions:

- How often do season-ticket holders actually attend games?

- What types of game attendance does a ticket-holder exhibit (family, friends night, business) and how often?

- How do regular attendees use the stadium and are there marketing cues that can help drive experience?

- Are there navigation or usage patterns that present opportunities for mobile app adoption, in-seat service or queue management, or other experience boosters?

One thought on “Sports Analytics, Stadium Analytics and Sports CRM”

Leave a Reply

You must be logged in to post a comment.

Hi Gary, Thank you this very interesting sport analytics post. Do you post often sport topics?